georgia property tax exemptions disabled

A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating index rate. If youre a veteran with a 70 disability rating then youre.

Cherokee County Tax Assessor S Office

Property Taxes in Georgia.

. Chief Tax Appraiser Roy G. Up to 25 cash back Senior Citizen Exemptions From Georgia Property Tax. If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a.

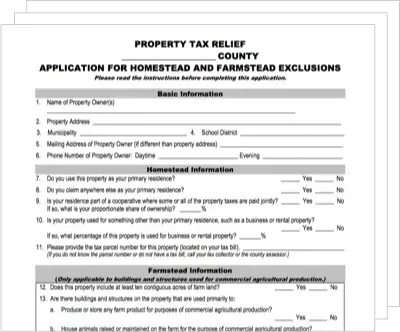

There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens. To qualify for a 12000 exemption 70 of a homes occupants must be. In addition you are automatically eligible for a.

Disabled veterans their widows or minor children can get an exemption of 60000. Discharged under honorable condition. Chief Deputy Appraiser Stephanie Gooch.

Any qualifying disabled veteran may be granted an exemption of up to 50000 plus an additional sum from paying property taxes for county municipal and school purposes. All tools and implements of. Currently there are two basic.

Letter from VA stating the wartime veteran was. Individuals 65 years or older may claim an exemption from. Property Tax Returns and Payment.

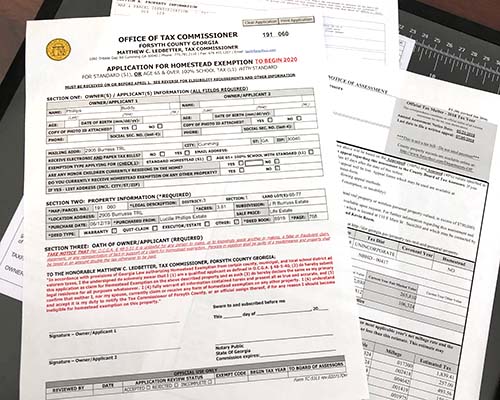

S5 - 100896 From Assessed Value. To apply for a. The 2020 Basic Homestead Exemption is worth 27360.

To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter. All veterans with a disability rating of 100 are exempt from paying property taxes in the state of Texas. Military veterans who have a 100 disability rating are exempt from all property taxes on homes up to 300000.

Veterans Exemption 100896 For tax year 2021 Five ways to be eligible. People living in the house cannot have a total income of more than 30000. Disabled Veteran Exemption and Conservation Use Exemption are some common exemptions a property owner may qualify for.

Property Tax Homestead Exemptions. Items of personal property used in the home if not held for sale rental or other commercial use. Georgia exempts a property owner from paying property tax on.

This is a 10000 exemption in the county general and school general tax categories. The qualifying applicant receives a substantial reduction in property taxes. A letter from the Veterans Administration stating that the veteran has a 100 Service Connected Disability and is totally.

If a member of the armed. Disabled Person - 50 School Tax Exemption coded L5 or 100 School Tax Exemption coded L6 If you are 100 disabled you may qualify for a reduction in school taxes. County Property Tax Facts.

DeKalb County offers our disabled residents special property tax exemptions.

Georgia Property Tax Liens Breyer Home Buyers

What Is The Veterans Property Tax Exemption The Ascent By Motley Fool

Public Hearing To Address Property Tax Exemptions News Oswegocountynewsnow Com

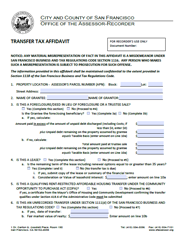

Transfer Tax Affidavit Ccsf Office Of Assessor Recorder

Georgia Homestead Exemption Reminder Brian M Douglas

Petition Jackson County Georgia Senior Exemption For Eliminating School Taxes Change Org

Veteran Tax Exemptions By State

Gwinnett County Property Tax Reduction Tax Exemptions

Are There Any States With No Property Tax In 2022 Free Investor Guide

Houston County Assessor S Office

Property Tax Exemption For Disabled 11 Things 2022 You Need To Know

Choosing An Exemption Richmond County Tax Commissioners Ga

Disabled Veterans Property Tax Exemptions By State

Choosing An Exemption Newton County Tax Commissioner

Veteran Tax Exemptions By State

Property Tax Exemptions For Disabled Veterans In Michigan And Missouri Homesite Mortgage